Buying a Van as a Sole Trader

When the time comes, and you realise your standard car just isn’t big enough for your business operations any more, the natural next step is to look into buying a van. But what’s the best way to buy a van self-employed? And can you get tax relief on a van purchase as a sole trader?

Navigating the market can be tricky if you’re unsure how to begin. Whether you’re a builder, plumber, electrician or other tradesperson wanting a van for business operations, or a self-employed individual wanting to find the most cost-effective and tax-efficient way to buy a van for your work, this article will explain all there is to know about buying a van.

Let’s get started.

Table of Contents

- If you buy it outright, you can claim 100% of the van’s cost against your business’s capital allowance.

- Van leasing, hiring or finance plans are available for individuals not wanting to purchase outright.

- Your credit rating and salary information will dictate the fees offered to you based on whether you’re a financial risk to the lender.

- Enlisting an accountant is the best way to ensure you know your tax relief benefits as a self-employed individual

How Much Can I Claim For My Van?

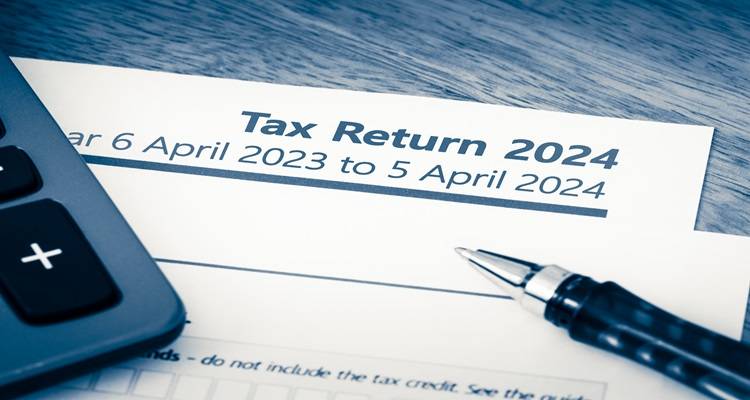

When you register as a self-employed trader, you can claim tax relief on certain business expenses. If you purchase a van for your business, this will become one of those such things. But how much can I claim for my van as a self-employed individual?

The short answer? You can claim 100% of the van’s cost against your business’s capital allowance. Let’s add some detail to that.

Calculating the tax relief on a van purchase as a sole trader can seem overwhelming, so let’s break it down. Gov.uk states that you can claim “allowable business expenses”, which include:

- Office costs

- Travel costs, such as fuel, parking, and travel fares

- Clothing expenses for uniforms

- Staff costs, such as salaries

- Stock or raw materials if they’re bought to re-sell

- Financial costs, such as insurance or bank charges

- Business premises costs, such as utilities and rent

- Advertising and marketing costs

If we break down travel costs, we can get some granular details:

- Vehicle insurance, breakdown cover and licencing fees

- Repairs and servicing

- Fuel

- Parking

- Hire charges

The actual purchase of a vehicle, such as a van for business purposes, can be claimed as a capital allowance, which means you can deduct part of the value from your profits before you pay tax. If you are a sole trader, you can claim simplified mileage expenses on your vehicle instead.

You can calculate this by using a flat rate for your vehicle’s mileage, and for this exercise, vans come under goods vehicles. Gov.uk states the following rates apply:

| Vehicle Type | Flat Rate Per Mile (Using Simplified Expenses) |

|---|---|

| Cars and goods vehicles first 10,000 miles | 45p |

| Cars and goods vehicles after 10,000 miles | 25p |

Putting this into context, if you drove 20,000 business miles in a year, the calculation would be 10,000 x 45p (£4,500), then the 10,000 extra miles over the initial 10,000 at 25p (£2,500), making a total claim of £7,000.

Buying A Van As A Sole Trader

So, how do you go about buying a van as a sole trader? Let’s examine the pros and cons of the different routes of purchase, from outright ownership to hiring and leasing, to help you find the best solution for your business needs.

Outright Purchase

By purchasing your van outright, you can claim 100% of the van’s cost against your business’s capital allowance, making it a savvy financial decision. This being said, if your company isn’t turning a profit, this won’t help you out as you need to deduct the price of the van from your profits before calculating corporation tax.

It’s important to note that Gov.uk has strict requirements of what is classed as a van and what isn’t.

It’s also worth mentioning that this concerns your van’s business use–if you use it for personal use as well, calculating the tax relief can be confusing and less straightforward than if it was solely used for business purposes.

If used for business purposes, you will also be able to claim the following as tax relief:

- Vehicle insurance, breakdown cover and licencing fees

- Repairs and servicing

- Fuel

- Parking

- Hire charges

The main advantage of purchasing your van outright as a self-employed individual is that you are solely accountable for it and won’t be caught up in lease or hire cost hikes or interest rate rises with bank loans.

The main disadvantage is that your vehicle will be your sole responsibility, so if anything goes wrong with it, you will need to cover the repairs yourself, as there won’t be a third party involved to sort out the issues for you.

| Advantages of Outright Purchase | Disadvantages of Outright Purchase |

|---|---|

| Not subject to interest rates rising (bank loans) or monthly/yearly costs increasing (hiring/leasing) | Higher initial cost and investment |

| Tax deductible expense | Responsible for all maintenance and repairs |

| No cap on mileage | Vehicles depreciate after purchase |

Hire Purchase (HP)

A hire purchase can be a great way of getting the vehicle size you need without all the added stress that comes with outright ownership. There is no large financial outlay, and the cost can be spread over a period of time to suit your financial situation.

Usually set across 12, 24 or 48 months, you can decide what deposit you put down and your fixed monthly payments thereafter. There are usually no mileage restrictions, and you can choose to settle the payments early if your financial situation allows, and you will eventually own the vehicle at the end of the term.

| Advantages of Hire Purchase | Disadvantages of Hire Purchase |

|---|---|

| You will eventually own the vehicle but won't have a hefty financial outlay | Monthly payments are usually higher than leases as a result of this |

| You can choose your deposit amount to suit your financial situation | Your choice of vehicle/model may be restricted to certain types |

| Usually, there is no cap on mileage | Interest rates can fluctuate, increasing your monthly payments |

Leasing

Leasing a van for business purposes is a popular choice as you can opt out if necessary and your monthly repayments are typically consistent and fixed. Unlike hire purchase, you will be able to choose from a number of makes/models, and you will have some tax exemption benefits.

However, you are tied into a monthly contract when leasing, and if you stop making payments or miss a payment date, you can lose the vehicle. You won’t get the vehicle at the end of the lease, and in some cases there may even be a final balloon payment to pay, making it an expensive option for some.

| Advantages of Leasing | Disadvantages of Leasing |

|---|---|

| Typically consistent, fixed monthly fees | Tied into a contract |

| More extensive range of makes/models than with hire purchase | Can lose the vehicle if you miss a payment |

| Usually, there is no cap on mileage | Final balloon payment may be administered |

Other Options

There are a number of finance plans available for those wanting to lease or buy a van for business purposes. These range from Contract Hire (BCH), a fixed term contract, and Personal Contract Purchase (PCP), a flexible finance plan.

BCH is a good all-rounder option as the terms often include tax, services and breakdown cover, effectively giving you an all-in-one solution.

| Advantages of BCH | Disadvantages of BCH |

|---|---|

| Low initial deposit | You won't own the van at the end of the contract |

| Vehicle warranty included, as well as road tax | Tied into a specific mileage allowance |

| The choice to terminate the contract or trade-in for another van at the end of the term | Additional fees if you go over this allowance |

PCPs are determined by your expected mileage and the deposit you can put down in the beginning, and you can end the contract by either owning the vehicle or upgrading for a new model again on PCP.

| Advantages of PCP | Disadvantages of PCP |

|---|---|

| Can also include breakdown cover, services and tax | Tied to expected mileage |

| You can own the van at the end of the term or part-ex for a new model | If you go over your mileage, you may encounter additional fees |

| Monthly payments can be lower than some other options if your initial deposit is high | Certain models/makes may be excluded |

Van Finance Requirements

Let’s take a look at the requirements you might need if you’re looking to hire a van on finance:

- Proof of identity and address

- Proof of income (for self-employed individuals, this will be the SA302 generated once your tax return has been filed at the end of a financial year)

- Age (you will typically need to be between 20 and 75 years old)

- Driving licence

- Credit check (lenders will carry this out to calculate their risk of lending to you)

The better your credit score, the lower your rates are likely to be as you’ll pose less of a risk to the lender, while the opposite is also true–higher rates will commonly be seen for those with lower credit scores who pose more of a financial risk to the lender.

Van finance is typically straightforward to acquire if you have a solid employment record and proof of income, as well as a clean driving licence and good credit score.

Considerations

When dealing with financial choices, it’s prudent to consider the implications of certain finance plans or deals.

Unless you’re buying the van outright, you’re unlikely to be able to modify its appearance. If this is a main concern for you, you may want to look for a second-hand vehicle that you can get for a reasonable price in order to make your modifications in a cost-effective way. Similarly, you may have signage on the vehicle if it’s a lease or hire, which can deter some individuals from these routes.

Wear and tear happens, but if it’s more than what is considered “acceptable” by leasing or hiring companies, you may be subject to additional fees at the end of your contract. The same goes for mileage and use–if you overshoot your predicted mileage by a large amount, you will be charged for it–again, this is something that won’t be an issue if you own your van outright.

Some plans will include maintenance and breakdown cover, as well as road tax, while others won’t. If you have your van outright or are leasing/hiring, you’ll likely have to foot these bills yourself–but some portions of the costs may be tax deductible if you’re using the van exclusively for business use.

Lastly, access to finance offers and plans can be a roadblock for some. If your credit rating isn’t high, and if you can’t prove a stable income, you may encounter issues getting approved for finance deals on a van.

Conclusion

By now, you should have a better understanding of what’s involved in hiring or purchasing a van for your self-employed business and what the best option for you might be given your financial situation.

Here are our key takeaways:

- If you buy the van outright, you can claim 100% of its cost against your business’s capital allowance.

- Travel costs–vehicle insurance, breakdown cover, licencing fees, fuel, parking, and hire charges—can be listed as tax relief if your van is being solely used for business purposes.

- If you don’t want to buy your van outright, you have several options, including leasing, hiring, and finance plans.

FAQs

What Size Van Do I Need?

If you need something bigger, Luton vans–also known as Luton box vans–are the vehicles most commonly seen with “man and a van” services, like removal companies. Luton vans come in two sizes, 3.5 tonnes and 7.5 tonnes. For something even bigger, crew vans can be a great choice for individuals needing to transport equipment as well as people, with removable seats for dual purpose.

Is It Better to Buy a New or Used Van?

New vans will typically be covered by warranty periods, meaning if any issues crop up during use the fixes will be covered, whereas with used vehicles these repairs will come at your own cost. Deciding whether to buy a new or used van comes down to your preferences and what you’re comfortable with when it comes to potential repairs.

What Size Van Can I Drive on a Normal Licence in the UK?

Drivers who passed their test before 1997 may also have a C1 classification which permits the holder to drive vans with a GVW of up to 7.5 tonnes.

How Much Should I Set Aside for Van Costs?

How Do I Know If a Van Is Necessary for My Business?

If you’re finding your car isn’t quite right for your load, then a van might be necessary for your business.

Sources

https://www.gov.uk/expenses-if-youre-self-employed/travel

https://www.gov.uk/simpler-income-tax-simplified-expenses/vehicles